Land, Tariffs, and Taxes: The Forgotten Story of America’s Progressive Power Shift

With the short-term mindset of modern politics, we gloss over the historical interrelatedness of tariffs, land management, monetary policy, income taxes, and the shadowy rise of the progressive party – and it does matter.

Teddy Roosevelt was a controversial, compromise candidate for Vice-President running with President McKinley in 1900. Eight months into his second term, McKinley was assassinated by Leon Czolgosz, a socialist-progressive (often referred to as the Anarchist party). Roosevelt, then, ushered in the elitist-progressive movement.

Up to this point, the primary sources of federal government revenue were tariffs and land sales. Lincoln’s Homestead Act of 1862 was designed to expand the Western frontier.

Political hypocrisy at its best, Roosevelt’s platform was to control the growing capitalism of corporations while he simultaneously cozied up to figures like J.P. Morgan, Carnegie, Ford, Edison, Rockefeller, and other magnates.

Roosevelt is held out as “the conservation president.” Yet, the reality is that these influential friends encouraged the Antiquities Act of 190,6, allowing Roosevelt to remove large tracts of land from private sales in the name of preserving landmarks, lands of scientific interest, and natural national monuments. The reason – the Western states were loaded with natural resources (oil, gas, and minerals), where the elite class would eventually have greater access to these resources as they were discovered, not some unwitting rancher or farmer.

Today, the government owns about 30% of all lands, and 92% of twelve Western states. At least 46% of all crude oil is on government-owned land.

In Midwest states, most land is privately owned. Decades later, President Nixon’s administration created the Environmental Protection Agency (EPA), the General Authorities Act of 1970, and the Endangered Species Act. Since the government did not own the land to determine leasing and allocation, the government repeatedly declared some animal species ‘endangered’ to prohibit a landowner’s access to their own natural resources.

The hypocrisy of each example would need to be separate articles, from the Dakota Skipper Butterfly and the Desert Tortoise (simultaneously being removed for overpopulation), to the Kansas Prairie Chicken (simultaneously being slaughtered by wind farms!!!).

Roosevelt also set in motion the Federal Reserve Act of 1913, to establish a highly unique public/private central bank that not only set monetary policy but also printed the national currency notes (the Reserve held the actual precious metals). Left to the shadows of history is the bank run of 1907 and whether it was an artificial crisis for Roosevelt to champion the century-old debate of establishing a national bank.

Roosevelt parlayed the new statutory foundation to supplant land sales and tariff revenues with a federal income tax. You see, in 1894, the U.S. Supreme Court held that an individual income tax was unconstitutional. Thus, in 1913, Congress passed income tax statutes in conjunction with the new Sixteenth Amendment, establishing a Constitutional override to the Court. Congress also passed the Tariff Act of 1913 to lower tariffs and gave the President the authority to set tariff rates. The Organic Act of 1913 established the National Park Service with expanded authority for the President to declare ownership of land, even when millions of acres of these “public parks” have no public access. The winners? – wealthy elitists. The losers? – the common working women, men, and their families.

Wait! Woodrow Wilson signed most of these laws, not Roosevelt. Well, Roosevelt promised he would not run for a third term in 1910. He handpicked his Secretary of War, William Howard Taft, to succeed him. However, after being elected, Taft broke away from the progressive movement. Outraged, Roosevelt, who still had his hands heavy into guiding national policy and the cabinet, formed the Progressive Party (dubbed the Bull Moose Party), confident that he would be back in the White House to implement the policies he fostered. This split the vote three ways and ultimately gave Woodrow Wilson the Oval Office in an election where Wilson was the serious underdog.

Wilson (who academically published The History of the American People, 1901, was sympathetic to the KKK and spawned the infamous film Birth of a Nation (1915), was sworn into office in March 1913. These pieces of legislation, and a Constitutional Amendment, were already on the drawing board and in play when Wilson surprisingly won. Wilson simply held the pen.

In the 1920s, with a surging economy, WWI ended, and a waning of the progressive movement, tariffs were back in play, reaching an average of 40% on many goods, and up to 50%. The Tariff Act of 1922 also allowed the President to raise or lower tariffs by up to 50%. President Hoover had increased tariffs as the Great Depression hit. The wealthy elitists begged Hoover to veto a new tariff bill intended to help farmers (not the elitists). Despite the debates, the high tariffs failed, not as being protectionist, but because the European banks were also failing and could not support the U.S. tariffs, especially with the hyperinflation of the Weimer Republic, as their own agricultural sectors were in financial crisis.

There’s always a lot more detail to each of these intersecting economic issues. The post-WWII policies also paint a more elaborate landscape for the interaction of these policies. Nonetheless, from Teddy Roosevelt to his cousin FDR and Teddy’s niece, Eleanor, the roots of dramatic change arise from the elitist progressive movement – and perhaps now, the Democratic-Socialist Party.

RECENT

BE THE FIRST TO KNOW

More Content By

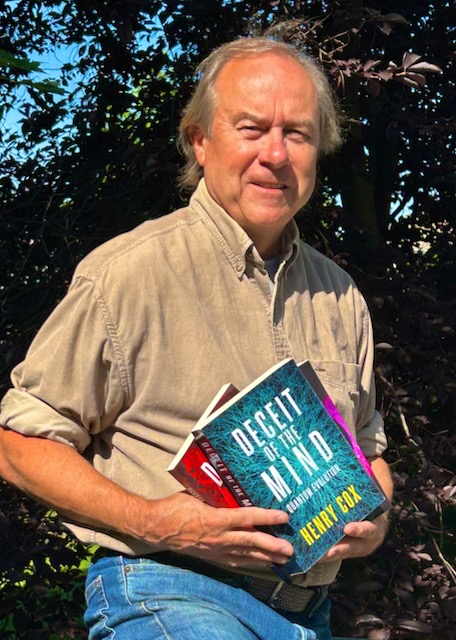

Henry Cox